18+ Oklahoma Salary Calculator

Web US Tax 2024 Oklahoma Salary and Tax Calculators Welcome to iCalculator USs dedicated page for income tax calculators tailored for Oklahoma. Well do the math for youall you need.

College Of Professional And Continuing Studies The University Of Oklahoma

The results are broken up into three sections.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70828013/usa_today_17493603.0.jpg)

. Web Oklahoma Paycheck Calculator Calculate your take-home pay after federal Oklahoma taxes Updated for 2023 tax year on Dec 05 2023 What was updated. Web Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. For more information see.

Web Paycheck Calculators by State. Use iCalculator USs paycheck calculator tailored for Oklahoma to determine your net income per paycheck. Web Below are your Oklahoma salary paycheck results.

It will calculate net paycheck amount that an employee will receive. Web If your gross pay is 5500000 per year in the state of Oklahoma your net pay or take home pay will be 45952 after tax deductions of 1645 or 904800. Every state in the US.

This applies to various salary. Examples of payment frequencies include biweekly semi-monthly. Designed for user-friendliness its accessible to individuals from all backgrounds.

Web Paycheck Calculators by State. Web Calculate your annual take home pay in 2023 thats your 2023 annual salary after tax with the Annual Oklahoma Salary Calculator. Find your take home pay in Oklahoma using Forbes Advisors Paycheck Calculator.

Payroll check calculator is updated for payroll year 2023 and new W4. Web The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Web Oklahoma Paycheck Calculator.

Has its unique tax rates and regulations which can influence your net earnings. Just enter the wages tax withholdings and other. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states.

Simply enter their federal and state W-4. Simply choose your state. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

A quick and efficient way to compare annual. Web The graphic below illustrates common salary deductions in Oklahoma for a 18k Salary and the actual percentages deducted when factoring in personal allowances and tax. Web The Oklahoma Salary Calculator is your trusted ally in calculating your net pay within the state.

Paycheck Results is your gross pay and specific deductions from your. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Oklahoma. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local.

Web Oklahoma Paycheck Calculator. Web How much are your employees wages after taxes. The state income tax rate in Oklahoma is progressive and ranges from 025 to 475 while federal income tax.

Web Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web What is the income tax rate in Oklahoma. Web Oklahoma Hourly Paycheck Calculator.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Oklahoma. Web Paycheck Calculator Advertiser Disclosure Paycheck Calculator For Salary And Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your.

Jobber

2

Paycheckcity

Kentucky Sports Betting

888 Sport

1

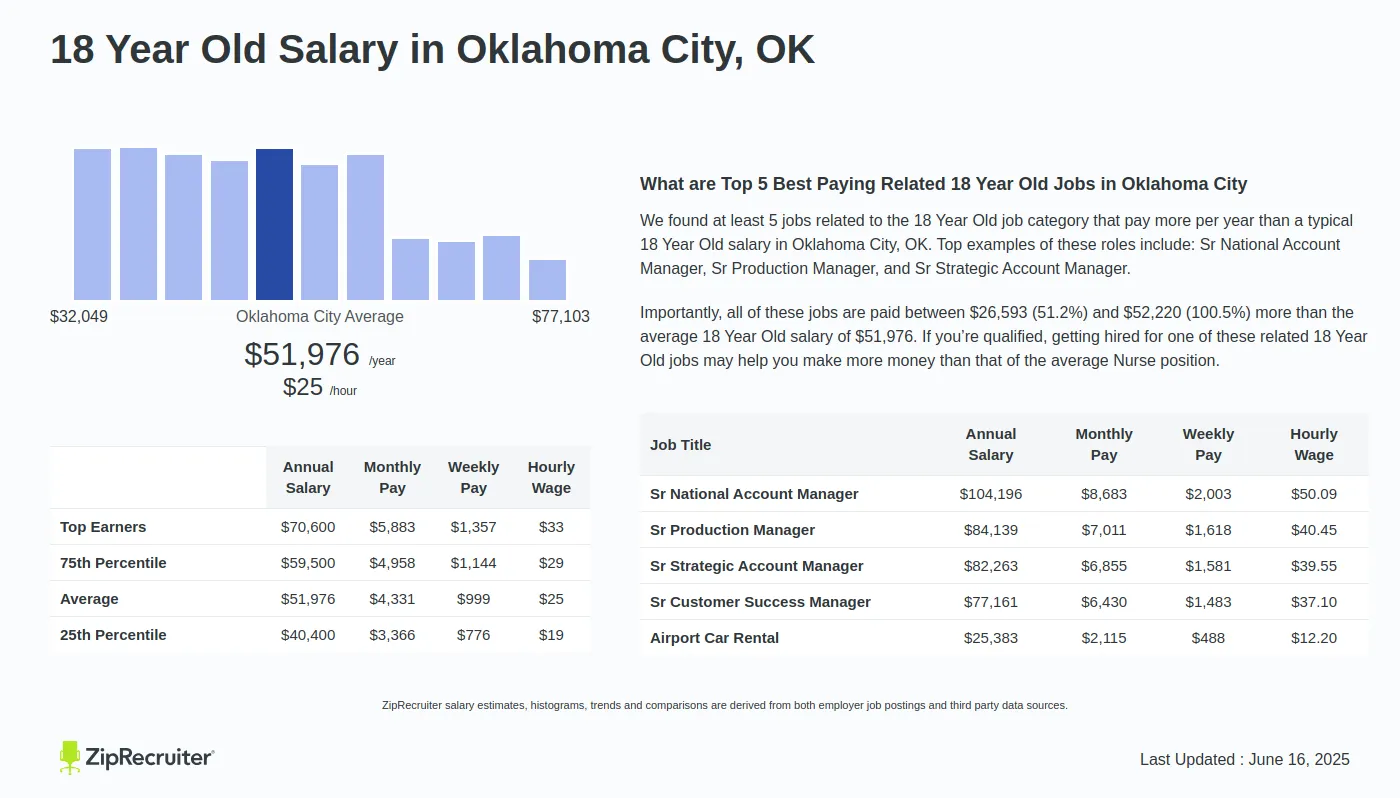

Ziprecruiter

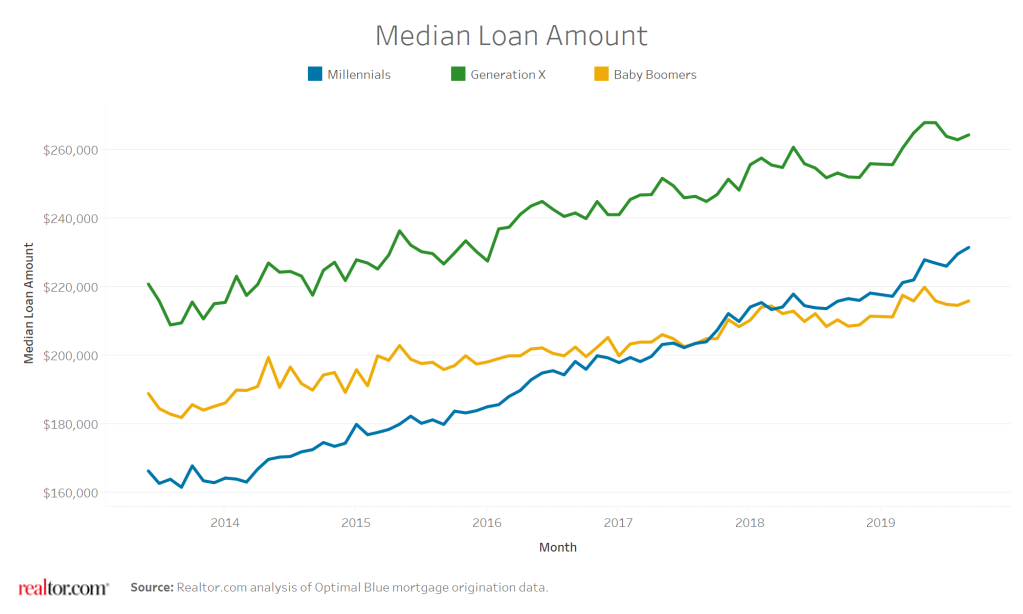

Zillow

Spotrac Com

2

Template Net

1

888 Sport

1

American College Of Clinical Pharmacy Wiley

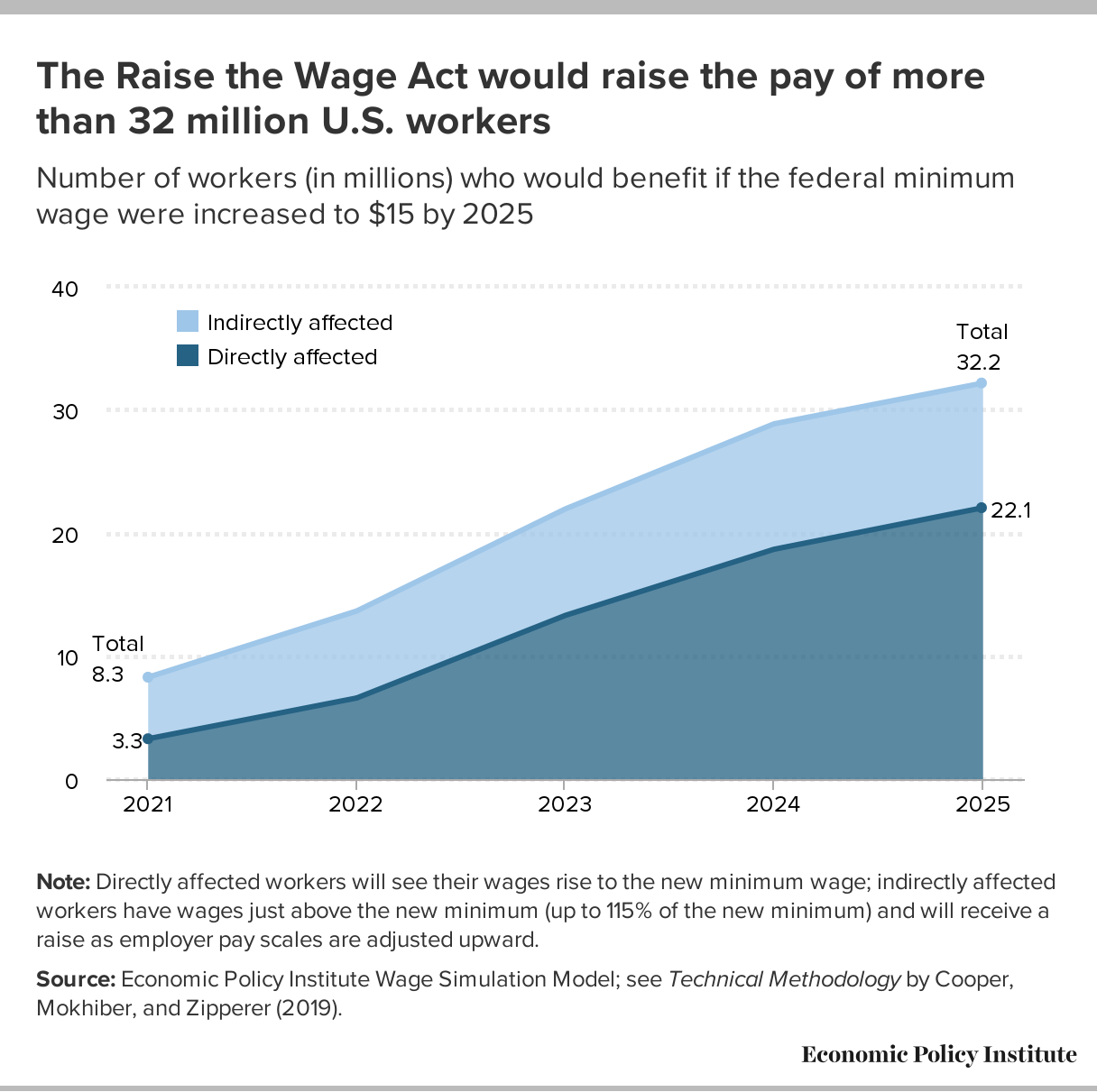

Economic Policy Institute

Express Employment Professionals